what happens to your social security number after you die

Jo's husband died when he was 44. Jo was simply 43, and up until that point, they ran a successful plumbing supply business together. Jo and her husband earned a loftier income, and his passing left her with the burden of running a demanding business alone.

She didn't spend a lot of fourth dimension thinking about her future Social Security benefits at that signal of her life. But things are different now.

Jo is well-nigh to turn lx. She'south been told that she can authorize for Social Security survivors benefits, and has also heard that the Social Security Administration has a history of miscalculating these benefits — so Jo wants to make sure she understands the math herself.

You Tin can't Use the Normal Calculations to Understand Social Security Survivors Benefits

Jo watched my video on how to calculate Social Security benefits, but she walked away feeling thoroughly confused. That'south not how I want any of my viewers to leave my videos, merely on this i… I can sympathize why.

(This is also why I recorded a new video called "What If Yous Dice Early?" to make sure other viewers have more resources!)

What was the problem? The video itself wasn't confusing. The outcome lies in the fact that well-nigh people don't know that Social Security survivor benefits are not always calculated the same fashion that retirement benefits are calculated.

At that place are alternate calculations that are used if you dice early.

The Alternate Calculations to Empathise If a Spouse Dies Early on

Whether you're trying to figure out what your benefit volition be considering you've lost a spouse or perchance you lot're building a retirement plan and running some "what-if" scenarios for your ain partner, agreement these alternate calculations is really of import.

Unfortunately, a lot of people, including fiscal planners, become this wrong because they are relying on the software they apply to tell them how to plan for risks that occur before retirement.

But you lot can't do that with Social Security.

These software programs don't always know who is eligible for a benefit, nether what conditions are they eligible and about importantly, how that specific benefit is calculated.

I want to break this commodity down into iii sections. Here's what we'll embrace:

- How to determine if the person who died worked for enough years for survivors benefits to exist paid from their work record

- Who is eligible to receive survivors benefits

- How Social Security survivors benefits are calculated

Let'due south dive into these details below.

Function I: Is the Work Tape Long Enough to Pay Out Social Security Survivors Benefits?

Before any of your beneficiaries to receive survivor benefits, you must work for plenty years to be considered "insured" for Social Security.

There are ii different ways you can be "insured," but the big, broad dominion is that if you lot worked for at least 10 years, your beneficiaries tin receive survivor benefits. That beingness said, in that location are exceptions to this, where beneficiaries could still receive a survivor benefit if the piece of work record is shorter than ten years.

This is an important dominion to sympathize for individuals who die young. To determine whether a person worked long enough to qualify for benefits, the Social Security administration counts piece of work history by credits.

Y'all take to have a sure number of these credits to be considered "insured" past Social Security. In 2019, you go ane credit for every $1,360 dollars in earnings and yous tin earn upwardly to 4 credits per yr. (The earnings amount required for a credit generally increases on an annual basis.)

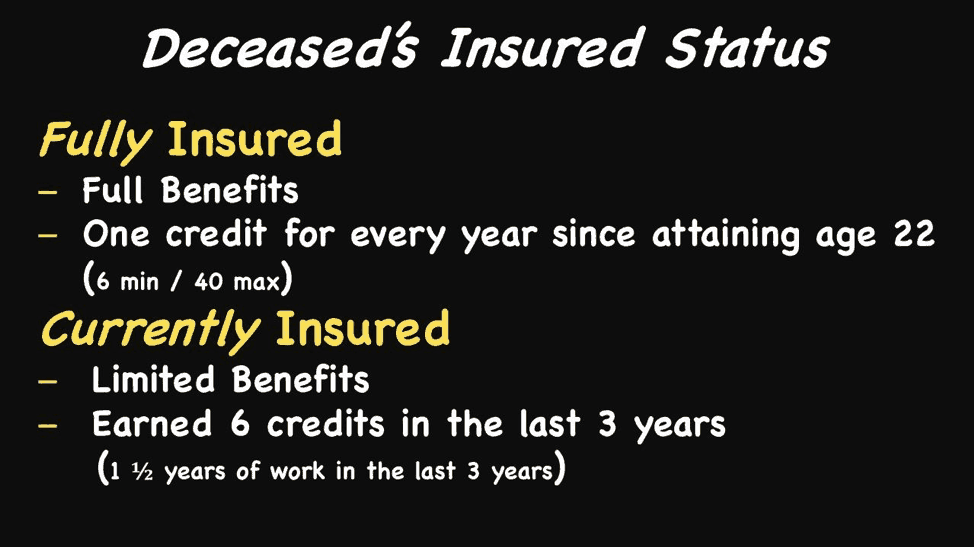

Depending on the age of death and number of credits obtained at that fourth dimension, a person will either be:

- Fully Insured, which ways your beneficiaries can receive full benefits payment

- Currently insured, which means Social Security volition only pay a limited corporeality of benefits.

I'll get into the weeds on the differences in payments in just a moment. For at present, know that to be considered fully insured, you need to take earned one credit for every year since you turned 22. You lot demand a minimum of 6 credits, but you never need more than 40.

For case, let'south say yous were to die at 40 (distressing). In that case, you'd need at least eighteen credits to be considered fully insured by the Social Security Administration:

Part II: Who Can Receive Survivors Benefits?

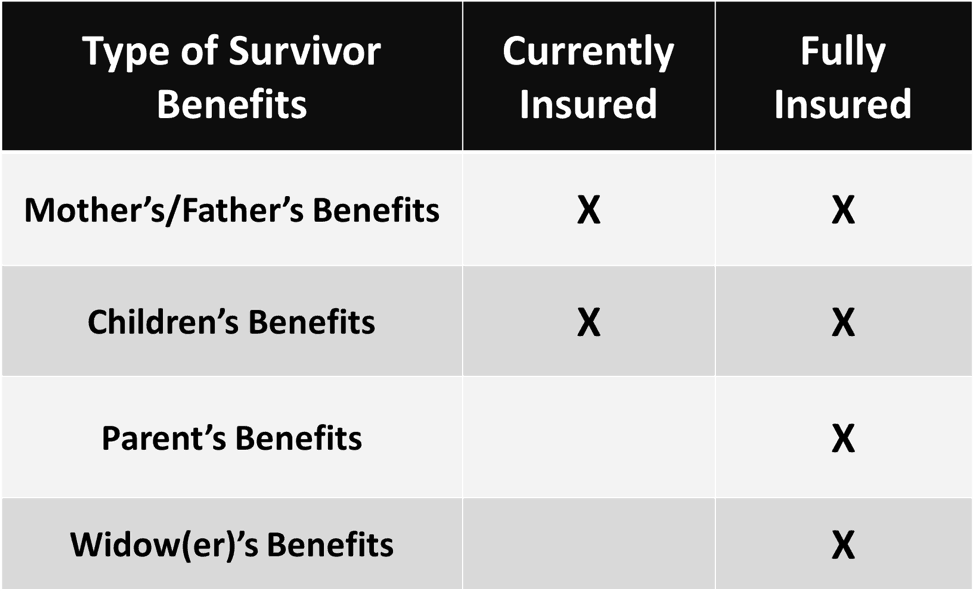

At that place are 4 unlike types of survivor benefits:

- Widow(er) benefits: This is what we traditionally remember of when we recall well-nigh survivors benefits; you die and your spouse can go a survivors do good.

- Mothers' and fathers' benefits: These are likewise known as child-in-care benefits, and they will pay a survivors benefit to a spouse who is taking care of your children under the age of 16[one]

- Benefits payable to children: Children can receive a portion of your full retirement age benefit up until they achieve machismo.

- Benefits payable to your dependent parents: Not many people know about this one, just in curt, they pay benefit to your parents if they were receiving at least ane half of their back up from you lot when you died.

These different do good types each work differently with your insured status. If you are fully insured, your beneficiaries can receive whatsoever of these benefit types.

But if you are "currently insured" (or you only have one and a half years of work on your piece of work record for the last three years), then Social Security would merely pay out the mothers' and fathers' benefits or children'south benefits. Your spouse would not receive parents benefits or the traditional survivor benefits in one case they retired.

Part 3: The Alternate Calculation for Early Decease

To really understand how the Social Security Assistants calculates survivors benefits, allow's do a quick review of the usual adding for an private who has a long piece of work history. There are iii basic steps:

- Accommodate historical earnings for inflation.

- Get monthly average from the highest 35 years

- Use monthly average to benefits formula

The issue of this three-step calculation is your Primary Insurance Corporeality, or PIA. This is too your full retirement age benefit. Your own retirement benefit is based on this calculation — and other benefits, like spousal and survivor benefits, rely on your piece of work tape likewise.

But what happens if you die before you've worked 35 years? What if yous merely worked for 20 years?

With retirement benefits, 35 years are used in the adding to make up one's mind the benefit whether you've worked 35 years or non. So if you've simply worked for 20 years, your earnings history volition show 20 years and earnings and 15 years of zeros.

Needless to say, zeros in a calculation will bulldoze down the average. And if someone dies early, and then there could exist quite a few zeros in their last 35 years of work history, correct?

That would be unfortunate, but thankfully, survivors benefits aren't calculated in the exact same manner every bit retirement benefits.

If someone dies, there is an alternate calculation that differs from the normal calculation in ii fundamental areas:

Instead of using the highest-earning 35 years from a piece of work history, the Social Security Administration will accept the number of years between the attainment of age 22 through the twelvemonth of death and drib off the lowest five years.

What's left is divided by the number of months in those years and that is ran through the formula that's constructive in the year of decease.

For case, say someone named John dies at age 40. The Administration would index his earnings for inflation look at the number of working years on his tape first at age 22 and ending at decease. In this case, that'due south 19 years.

Next, they'd drop off 5 of the lowest years. What would exist left would exist the highest fourteen years of John's earnings. Since in that location are 168 months in fourteen years, that would become his boilerplate indexed monthly earnings that would so exist applied against the benefits formula that was in issue that year.

The Other Primal Factor in Calculating Survivors Benefits: Windexing

In that location'due south one other key difference in the adding hither: equally long as the deceased person was nether historic period 62 when they died (along with a few other restrictions), the Social Security Assistants will perform another calculation to run across if it produces a higher result for survivors benefits.

This is called "windexing," and it's one of the Administration's famous word combinations that stands for Widows Indexing. This alternate adding compares the benefits payable from doing the adding with the formula in place during the yr of death so with the benefit payable from the twelvemonth the surviving spouse attains historic period sixty or the deceased would accept attained 62.

This is important considering the benefits formula more often than not increases every year and a higher benefits formula would produce a higher benefit.

Social Security survivors benefit tin make life a lot easier for the surviving spouse if a higher-earning spouse dies early. Understanding what to look in payments, and the basics of the calculations so you can spot inaccuracies, should be a central role of your retirement planning.

If want to learn more than, join me and nearly 290,000 others on my YouTube channel and Facebook grouping. It'due south very agile and has some really smart people who love to respond whatever questions you may accept near Social Security.

One final thing, be sure to get your Free copy of my Social Security Cheat Sheet. This is where I took the most of import rules and things to know from the 100,000 page Social Security website and condensed it downwards to but ONE Folio! Get your Gratuitous copy here.

Further Resources to Apply:

SSA research paper with description on the drop out years.

POMS: Base of operations Years, Computation Years, and Divisor Months

POMS: Insured Status

Excellent SSA research notes on the WINDEX

Source: https://www.socialsecurityintelligence.com/if-you-die-young-how-to-calculate-social-security-survivor-benefits/

0 Response to "what happens to your social security number after you die"

Post a Comment